The Origination Engine

Source services, refer leads, find opportunities, find investors. The universal exchange for professionals serving private capital

Opportunities

View All£1M

GBP 2.5 loan + warrants deal for UK AIM-listed energy company

Jexium Ltd. are acting for a UK public company to arrange a 3-year loan of from £1 to £2.5 million for a project which is important for the UK’s national transition to clean renewable energy. This ...

$5M

Syndicated deal with c30% discount available, proven US Infrastructure Autonomous Vehicle Tech Firm

Offer by proven & exclusive manager for primary or secondary investment opportunity in holding of US industrial autonomous vehicle technology with blue chip contracts, return x5 anticipated, net of fe...

£600K

UK-based HNW with £50m RE portfolio needs lender for Jersey Commercial Property transaction

Professional RE investor with extensive Commercial and Residential property portfolio valued c£50m, sub-20% LTV and £3m income p.a., seeks Jersey-based bank lender to support an initial portfolio inve...

£1.2M

Owner of UK manufacturer seeks lending line for acquisition opportunity, secured against commercial real estate

Successful UK business with £30m turnover and leader in manufacturing in sale of household materials with x25 acquisitions to date, seeks initial £1.2m funding line to acquire competitor (£2.5m cash p...

£1M

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s and/ or equity to meet contractual commitments in UK/ EU and target US dual IPO in next 12~18 months. Expression ...

€8M

Club Deal opportunity in Poland for professional investor, to close by YE 2023. Full occupancy yield 15% and IRR 30%+

A group of European investors is looking for one or more professional/ sophisticated co-investor(s) for a very attractive property transaction in Poland whereby an income producing asset (approx. 10% ...

£1M

£35m funding line available for purchase of Student Accommodation development opportunities in UK

Client is looking for opportunities in the UK to buy student accommodation sites or BTR schemes which are part built, distressed or in administration Large funding line up to £35m to deploy for Devel...

£500K

Co-investors sought for Biotech with commercialised infection prevention products for pre-listing funding

**Sophisticated investors only, enquiries via members please** Firm is the only company in the world to have registered a patent on a finished Hypochlorous Acid (HOCL) product, removing the need for a...

$5M

EU regulated fund 10Yr record raised USD500m, 3x returns, requires 3yr bridge at 20% coupon but min 1.3x

The fund has a >10yr track record and has raised approx. USD 500m to-date with robust return prospects for investors (>2-3x). Invests in mining for rare earth minerals in EMEA Ideally bridge for 3yrs ...

PoA

Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround

*Introducers Welcome* Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround. Selective invoice discounting allows you to forward fund invoices again...

$5M

Syndicated deal with c30% discount available, proven US Infrastructure Autonomous Vehicle Tech Firm

Offer by proven & exclusive manager for primary or secondary investment opportunity in holding of US industrial autonomous vehicle technology with blu...

£600K

UK-based HNW with £50m RE portfolio needs lender for Jersey Commercial Property transaction

Professional RE investor with extensive Commercial and Residential property portfolio valued c£50m, sub-20% LTV and £3m income p.a., seeks Jersey-base...

£1.2M

Owner of UK manufacturer seeks lending line for acquisition opportunity, secured against commercial real estate

Successful UK business with £30m turnover and leader in manufacturing in sale of household materials with x25 acquisitions to date, seeks initial £1.2...

£1M

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s and/ or equity to meet contractual commitments in UK/ EU and tar...

€8M

Club Deal opportunity in Poland for professional investor, to close by YE 2023. Full occupancy yield 15% and IRR 30%+

A group of European investors is looking for one or more professional/ sophisticated co-investor(s) for a very attractive property transaction in Pola...

£1M

£35m funding line available for purchase of Student Accommodation development opportunities in UK

Client is looking for opportunities in the UK to buy student accommodation sites or BTR schemes which are part built, distressed or in administration ...

£500K

Co-investors sought for Biotech with commercialised infection prevention products for pre-listing funding

**Sophisticated investors only, enquiries via members please** Firm is the only company in the world to have registered a patent on a finished Hypochl...

$5M

EU regulated fund 10Yr record raised USD500m, 3x returns, requires 3yr bridge at 20% coupon but min 1.3x

The fund has a >10yr track record and has raised approx. USD 500m to-date with robust return prospects for investors (>2-3x). Invests in mining for ra...

PoA

Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround

*Introducers Welcome* Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround. Selective invoice dis...

Wealth expertise, connected

Join our global community of trusted professional advisors

Family offices and leading professionals across the wealth industry

4,000+

professionals£400m+

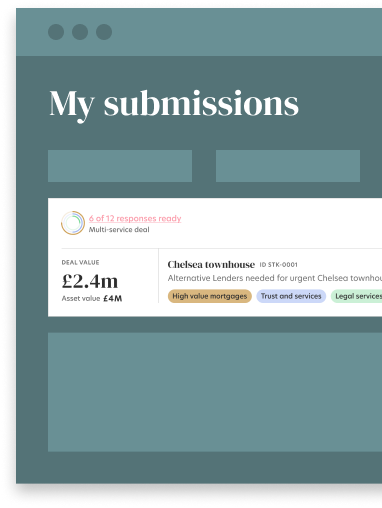

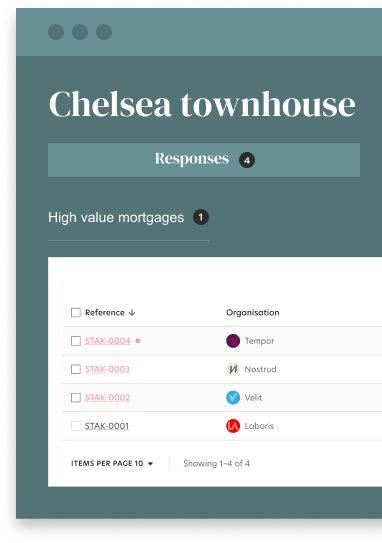

Deal flowWhat is STAK?

Wealth know-how, know-who

Post your requirements to a community of vetted, verified, top-tier wealth professionals and family offices, where client anonymity and ethics come first.

How does STAK work?

Wealth RFP in a box. Simple.

We know what questions to ask. Manage a fair and transparent, on-the-record competitive tender process where you get access to an amazing source of talent and opportunity, without compromising on the power of relationships. No BS and no charlatans. Just best practice.

Source opportunities & services

Family Offices need to balance appetite with privacy. STAK undertakes a whole-of-market search anonymously, on your behalf. Present a scenario or desired goals and we filter respondees to your criteria before introducing qualified parties. Find co-investors or vetted and verified service providers with total client anonymity and security.

Find opportunities

It is difficult to stand out or find engagements, and it is also challenging to help clients find alternative services transparently and efficiently. STAK is your Universal CRM: administer your referrals in and out, track and manage your tenders or bids via the STAK interface.

What makes STAK unique?

Meritocracy

Those who speak loudest are not necessarily those who deliver! STAK delivers meaningful performance insights at member and organisational level

Get StartedClient anonymity

STAK never captures your client identity: our entire ethos is based on trusted professionals representing client scenarios - once you are chosen we step away so you can do your thing!

Get StartedEthics first

We are passionate about transparency and the highest standards of conduct: STAK is designed to favour the good actors

Get StartedWhat members say about STAK

“A mix of Uber and Trip Advisor for Private Client Advisers, long overdue!”

Private Client Trustee

Jersey

“This team delivers: they expertly guided us through a re-selection process for a company administrator and bank at a critical time, having just received a major financing injection into our business.”

Chief Investment Officer

Privately Held International Telecoms Co.

“Genius idea, like a ‘professionals only’ open register of referrals and RFPs”

RH, Family Office

London

“I haven't got the time or skillset to maintain an awareness of lending rates and policies for my clients; STAK allows me to handle the marketplace in a really smart, easy way”

M. Wan

Kuala Lumpur

“The team at STAK have a deep understanding of the market within which family offices and large family businesses operate. I will be using them for all of our tenders going forward.”

Brian McCarthy

Managing Director, C. Le Masurier Ltd

Latest opportunities

View AllGBP 2.5 loan + warrants deal for UK AIM-listed energy company

Jexium Ltd. are acting for a UK public company to arrange a 3-year loan of from £1 to £2.5 million for a project which is important for the UK’s national transition to clean renewable energy. This transaction offers several attractions, particularly to a lender with experience in oil & gas and/or an interest in developing future business in the growing field of energy transition project finance: ▪ The value of the collateral offered is up to ~40x the amount of the Loan; ▪ The Company has no existing debt or other creditors – the Lender will be senior creditor for the term of the Loan; ▪ The Lender will receive Warrants to purchase listed ordinary shares in the Company at Loan maturity at a discount of 20% up to the amount of the Loan principal.

GBP 2.5 loan + warrants deal for UK AIM-listed energy company

Jexium Ltd. are acting for a UK public company to arrange a 3-year loan of from £1 to £2.5 million for a project which is important for the UK’s national transition to clean renewable energy. This transaction offers several attractions, particularly to a lender with experience in oil & gas and/or an interest in developing future business in the growing field of energy transition project finance: ▪ The value of the collateral offered is up to ~40x the amount of the Loan; ▪ The Company has no existing debt or other creditors – the Lender will be senior creditor for the term of the Loan; ▪ The Lender will receive Warrants to purchase listed ordinary shares in the Company at Loan maturity at a discount of 20% up to the amount of the Loan principal.

Deal Size

£1M

Syndicated deal with c30% discount available, proven US Infrastructure Autonomous Vehicle Tech Firm

Offer by proven & exclusive manager for primary or secondary investment opportunity in holding of US industrial autonomous vehicle technology with blue chip contracts, return x5 anticipated, net of fees. No Management Fees and performance threshold for Carry.This technology, tested and proven by major US railroads among others, has secured a $30M contract for 50 vehicles, with significant pipeline subject to capacity. The investment is attractive due to discount, labour/ automation incentives, scalable technology, minimal regulatory/ union risks (private land), and strong interest from logistics and military sectors. The venture has substantial backing and is poised for rapid growth with further investments. INVEST AT YOUR OWN RISK: WE DO OUR HOMEWORK BUT DO NOT UNDERTAKE PROFESSIONAL DUE DILIGENCE. Further detail enclosed, with data room available following NDA and qualified expression of interest.

Syndicated deal with c30% discount available, proven US Infrastructure Autonomous Vehicle Tech Firm

Offer by proven & exclusive manager for primary or secondary investment opportunity in holding of US industrial autonomous vehicle technology with blue chip contracts, return x5 anticipated, net of fees. No Management Fees and performance threshold for Carry.This technology, tested and proven by major US railroads among others, has secured a $30M contract for 50 vehicles, with significant pipeline subject to capacity. The investment is attractive due to discount, labour/ automation incentives, scalable technology, minimal regulatory/ union risks (private land), and strong interest from logistics and military sectors. The venture has substantial backing and is poised for rapid growth with further investments. INVEST AT YOUR OWN RISK: WE DO OUR HOMEWORK BUT DO NOT UNDERTAKE PROFESSIONAL DUE DILIGENCE. Further detail enclosed, with data room available following NDA and qualified expression of interest.

Deal Size

$5M

UK-based HNW with £50m RE portfolio needs lender for Jersey Commercial Property transaction

Professional RE investor with extensive Commercial and Residential property portfolio valued c£50m, sub-20% LTV and £3m income p.a., seeks Jersey-based bank lender to support an initial portfolio investment in Jersey, Channel Islands. Property is in St Helier, value £0.75m, will be subject of modernisation and refurbishment, and held in a company wholly-owned by the investor; will form the basis of a wider portfolio on the island over time. Source is regulated lending broker with existing professional relationship with the client.

UK-based HNW with £50m RE portfolio needs lender for Jersey Commercial Property transaction

Professional RE investor with extensive Commercial and Residential property portfolio valued c£50m, sub-20% LTV and £3m income p.a., seeks Jersey-based bank lender to support an initial portfolio investment in Jersey, Channel Islands. Property is in St Helier, value £0.75m, will be subject of modernisation and refurbishment, and held in a company wholly-owned by the investor; will form the basis of a wider portfolio on the island over time. Source is regulated lending broker with existing professional relationship with the client.

Deal Size

£600K

Owner of UK manufacturer seeks lending line for acquisition opportunity, secured against commercial real estate

Successful UK business with £30m turnover and leader in manufacturing in sale of household materials with x25 acquisitions to date, seeks initial £1.2m funding line to acquire competitor (£2.5m cash price, £0.9m on balance sheet, putting in £1.3m cash and seeks £1.2m lend). Security against high quality industrial premises, wholly owned and current lend 15% LTV), and clear evidence of cashflow to service the loan. Currently banked with major high street bank and seeking alternative source of financing at competitive rate.

Owner of UK manufacturer seeks lending line for acquisition opportunity, secured against commercial real estate

Successful UK business with £30m turnover and leader in manufacturing in sale of household materials with x25 acquisitions to date, seeks initial £1.2m funding line to acquire competitor (£2.5m cash price, £0.9m on balance sheet, putting in £1.3m cash and seeks £1.2m lend). Security against high quality industrial premises, wholly owned and current lend 15% LTV), and clear evidence of cashflow to service the loan. Currently banked with major high street bank and seeking alternative source of financing at competitive rate.

Deal Size

£1.2M

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s and/ or equity to meet contractual commitments in UK/ EU and target US dual IPO in next 12~18 months. Expression of interest for £5m CLN paying 10% with terms, warranties/ options to be negotiated, also £1m of equity (already drawn). Strong demand for product – ~£80m of LOIs (diverse) with initial contracts signed and supply underway. $8bn of global opportunity today; projected $50bn by 2027, with high barriers to entry. Extensively licensed by UK Government – GMP, MHRA and Home Office Licencing; early mover in highly regulated market. Listed on London Stock Exchange @ £100m valuation (outperforming AIM All Share index by 33% since IPO)

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s

Novel LSE-listed pharmaceutical company focused on pain relief: raising £10m of CLN’s and/ or equity to meet contractual commitments in UK/ EU and target US dual IPO in next 12~18 months. Expression of interest for £5m CLN paying 10% with terms, warranties/ options to be negotiated, also £1m of equity (already drawn). Strong demand for product – ~£80m of LOIs (diverse) with initial contracts signed and supply underway. $8bn of global opportunity today; projected $50bn by 2027, with high barriers to entry. Extensively licensed by UK Government – GMP, MHRA and Home Office Licencing; early mover in highly regulated market. Listed on London Stock Exchange @ £100m valuation (outperforming AIM All Share index by 33% since IPO)

Deal Size

£1M

Club Deal opportunity in Poland for professional investor, to close by YE 2023. Full occupancy yield 15% and IRR 30%+

A group of European investors is looking for one or more professional/ sophisticated co-investor(s) for a very attractive property transaction in Poland whereby an income producing asset (approx. 10% initial yield, 15% on full occupancy) can be bought at a very significant discount to replacement costs. In total there is a gap of approx. EUR 8-10m to be filled. This deal is urgent as the seller needs to get it done before YE, hence the attractive pricing. **STAK does not verify deal credentials you are responsible for your own due diligence, and opportunities are not accessible to retail investors**

Club Deal opportunity in Poland for professional investor, to close by YE 2023. Full occupancy yield 15% and IRR 30%+

A group of European investors is looking for one or more professional/ sophisticated co-investor(s) for a very attractive property transaction in Poland whereby an income producing asset (approx. 10% initial yield, 15% on full occupancy) can be bought at a very significant discount to replacement costs. In total there is a gap of approx. EUR 8-10m to be filled. This deal is urgent as the seller needs to get it done before YE, hence the attractive pricing. **STAK does not verify deal credentials you are responsible for your own due diligence, and opportunities are not accessible to retail investors**

Deal Size

€8M

£35m funding line available for purchase of Student Accommodation development opportunities in UK

Client is looking for opportunities in the UK to buy student accommodation sites or BTR schemes which are part built, distressed or in administration Large funding line up to £35m to deploy for Developers looking to exit existing finance arrangements that have come to an end

£35m funding line available for purchase of Student Accommodation development opportunities in UK

Client is looking for opportunities in the UK to buy student accommodation sites or BTR schemes which are part built, distressed or in administration Large funding line up to £35m to deploy for Developers looking to exit existing finance arrangements that have come to an end

Deal Size

£1M

Co-investors sought for Biotech with commercialised infection prevention products for pre-listing funding

**Sophisticated investors only, enquiries via members please** Firm is the only company in the world to have registered a patent on a finished Hypochlorous Acid (HOCL) product, removing the need for alcohol-based sanitising products. They have created a formulation that not only has excellent shelf life but additionally maintains efficacy in the presence of serum (blood, saliva, dirt etc). Up to £5m capital is currently being raised at a pre-money valuation of £58m (EIS shares and/or (ii) non-EIS convertible debt investment). This represents a 71% discount to the initial listing valuation of >£200m targeted by management at the Company’s planned IPO on the London Stock Exchange. To date >£14m invested in development of licensed technology into commercially viable products that meet an unmet public health need (funds raised via CLN) Two non-alcohol sanitising products already commercial, in active use in NHS. **Sophisticated/ Professional Investors ONLY** **Further details available within, verified members only**

Co-investors sought for Biotech with commercialised infection prevention products for pre-listing funding

**Sophisticated investors only, enquiries via members please** Firm is the only company in the world to have registered a patent on a finished Hypochlorous Acid (HOCL) product, removing the need for alcohol-based sanitising products. They have created a formulation that not only has excellent shelf life but additionally maintains efficacy in the presence of serum (blood, saliva, dirt etc). Up to £5m capital is currently being raised at a pre-money valuation of £58m (EIS shares and/or (ii) non-EIS convertible debt investment). This represents a 71% discount to the initial listing valuation of >£200m targeted by management at the Company’s planned IPO on the London Stock Exchange. To date >£14m invested in development of licensed technology into commercially viable products that meet an unmet public health need (funds raised via CLN) Two non-alcohol sanitising products already commercial, in active use in NHS. **Sophisticated/ Professional Investors ONLY** **Further details available within, verified members only**

Deal Size

£500K

EU regulated fund 10Yr record raised USD500m, 3x returns, requires 3yr bridge at 20% coupon but min 1.3x

The fund has a >10yr track record and has raised approx. USD 500m to-date with robust return prospects for investors (>2-3x). Invests in mining for rare earth minerals in EMEA Ideally bridge for 3yrs at 20% PIK interest but a min of 1.3x. Fund is exposed to mining but their commodities are sought after renewables commodities. Regulated fund with blue chip western investors (endowments, family offices etc.) Ideal investors are UHNW’s and Family Offices.

EU regulated fund 10Yr record raised USD500m, 3x returns, requires 3yr bridge at 20% coupon but min 1.3x

The fund has a >10yr track record and has raised approx. USD 500m to-date with robust return prospects for investors (>2-3x). Invests in mining for rare earth minerals in EMEA Ideally bridge for 3yrs at 20% PIK interest but a min of 1.3x. Fund is exposed to mining but their commodities are sought after renewables commodities. Regulated fund with blue chip western investors (endowments, family offices etc.) Ideal investors are UHNW’s and Family Offices.

Deal Size

$5M

Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround

*Introducers Welcome* Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround. Selective invoice discounting allows you to forward fund invoices against quality counterparties. Lender has funded invoices for SME's against Pfizer, Apple, Aviva, BUPA and many others across 45 OECD countries. Credit policies will apply. $1.5bn, 120,000 invoices financed, across 1,800 debtors. $50k to $5m funding lines with no PG's, Liens, Debentures. Invoices financed via proprietary technology in GBP/ USD/ CAD/ EUR among others. Process is simple: load confirmed invoice, invoice verified by payer against bank account IN YOUR NAME, invoice paid to you and when payment received you are immediately paid invoice net of fees. This is non-recourse: invoice financier takes the risk.

Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround

*Introducers Welcome* Invoice Discounter with £1.5bn financed to date, offering simple funding for SME's with 3 day turnaround. Selective invoice discounting allows you to forward fund invoices against quality counterparties. Lender has funded invoices for SME's against Pfizer, Apple, Aviva, BUPA and many others across 45 OECD countries. Credit policies will apply. $1.5bn, 120,000 invoices financed, across 1,800 debtors. $50k to $5m funding lines with no PG's, Liens, Debentures. Invoices financed via proprietary technology in GBP/ USD/ CAD/ EUR among others. Process is simple: load confirmed invoice, invoice verified by payer against bank account IN YOUR NAME, invoice paid to you and when payment received you are immediately paid invoice net of fees. This is non-recourse: invoice financier takes the risk.

Deal Size

PoA

Join today to source services, refer leads and find opportunities

Signing up takes seconds and, once verified, get alerts on new deals or invite or nominate colleagues & trusted contacts to tender